Fintech Development Outsourcing: Full Customer Guide

Fintech is one of those industries that has undergone radical transformations in recent years, is developing rapidly, and is characterized by a high level of technological progress. This is one of the reasons why companies working in the financial sector resort to outsourcing. This practice is becoming a reality for many companies, from startups trying to enter the market, to established financial institutions with a stable customer base and growing business operations. This article explains what the customers should consider while selecting a provider for fintech outsourcing.

Table of Content:

- Selection of the Cooperation Model

- Criteria for the Selection of the Fintech Development Company for the Cooperation

- Starting the Fintech Development Project

- Reasons to Resort to Outsourcing for Fintech Companies

- Conclusion

- Frequently Asked Questions

Selection of the Cooperation Model

First, a fintech company that has decided to resort to outsourcing must decide on a cooperation model. A correctly chosen cooperation model will provide the following benefits:

- Covering the needs of the organization in software development

- Closing technological gaps and obtaining expertise

- Speeding up solution development and reducing time to release a new product to the market or release additional functionality of an existing system

In general, there are 3 main models of cooperation:

Staff Augmentation

Team expansion refers to hiring one or more external specialists to strengthen the in-house team. This model involves the management of specialists from the customer’s side.

Dedicated development team

Software development provider offers the customer to build a dedicated development team. Many firms think that such a team can consist only of developers. Many firms believe that such a team can consist only of developers. But in reality, it is not so. The team may include developers and other specialists such as testers, designers, business analysts, project managers, DevOps, or other experts. The team’s composition depends on the specific customer and his business goals. Often, for large-scale fintech projects, there is a need to create several teams. For instance a front-end team, a back-end team, and a QA team. Another advantage of this model is that the customer can quickly scale the size of the team.

Development of the custom solution

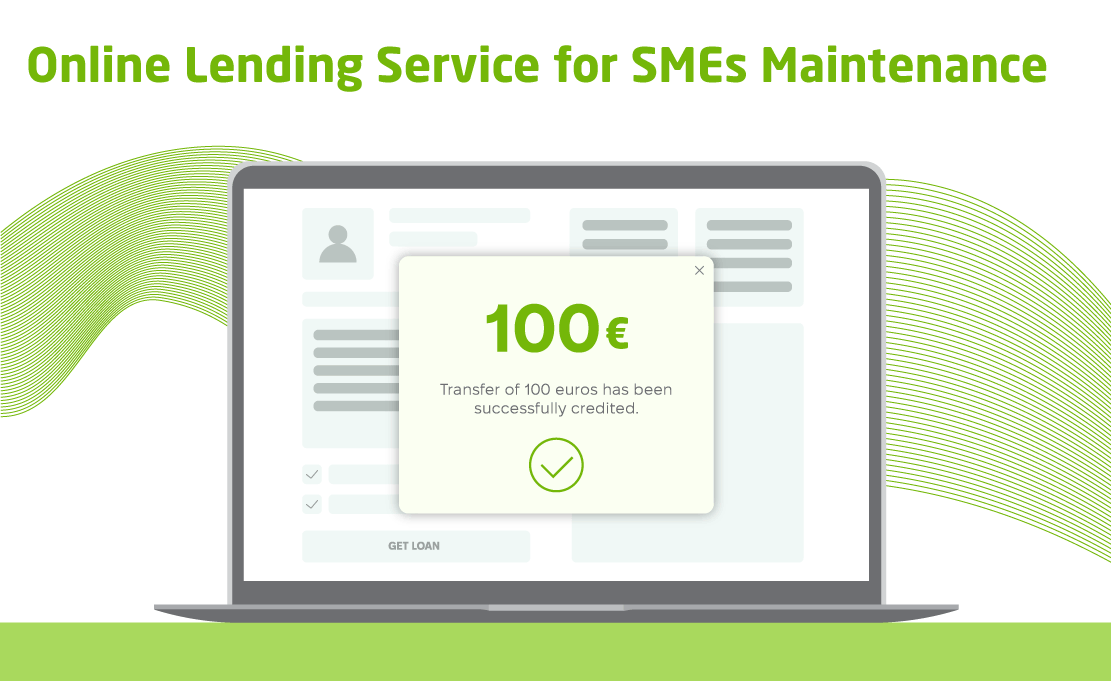

In this model, the service provider takes over all responsibility for fintech software development. In other words, the customer delegates to the partner everything related to the implementation of the solution, starting from the analysis stage and ending with the full release of the finished product and its support

Quite often, this model of cooperation is chosen by those organizations that do not have technical expertise. Another case is when the company has an IT department and software products but wants to develop either a new product or a unique functionality for the existing ones, the development of which requires the involvement of additional specialists with narrowly focused competencies without the need for hiring employees to the in-house team.

Criteria for the Selection of the Fintech Development Company for the Cooperation

There are a large number of companies on the market that offer software development services. Many factors should be considered when choosing a partner for outsourcing your fintech project. However, it is still possible to outline the main ones. In most cases, companies have specific industries they serve, where they have experience, knowledge, and relevant specialists. Therefore, when choosing a cooperation partner pay attention to his real experience in fintech.

Review the company portfolio and check the IT projects that were successfully implemented. Take into account the specifics of the project itself and the theme. For example, if the service provider developed an Internet banking solution, and the customer is looking for something similar – this can be a significant advantage. In addition, pay attention to the technological stack, approaches to software implementation, potential challenges, and ways to solve them.

Reviews about the services from previous and current customers of the company also play a big role in forming its reputation. You can find such reviews on the company’s website or independent review resources such as Clutch, and others. There are also many cases when new customers come to the service provider on the recommendation of current or former customers. Thus, the new customer already has confidence in the company, as others had a successful history of cooperation and were satisfied with the results, prices, and deadlines.

Another important factor is the company’s certifications, recognitions, and awards as a reliable fintech & software development provider by independent and unbiased organizations. Usually, companies show their certifications and awards on their website. However, this information can also be found in relevant resources publicly available. For instance, business magazines, press releases, catalogs of certifications, and more.

Verify that the service provider offers the development of secure and fintech industry standards and regulations-compliant solutions

Consider the location of the service provider by fintech development outsourcing because it affects the rate, processes, communication, accessibility, and legality.

Starting the Fintech Development Project

Organizational moments are quite an important stage before the start of work. Companies often sign an NDA before discussing the initial details of a project. Later the fintech company-customer and company-provider discuss all the details and conditions of cooperation and sign the main agreement. This agreement regulates the rights and obligations of both parties, terms, processes, IP rights, etc.

After all the organizational staff is completed, the work starts. One of the key points in cooperation is effective communication and a properly established work process. Well-established communication channels help avoid misunderstandings, promote clear management of project development, progress monitoring, clear setting of tasks and prioritization, reporting, contribute to process transparency, rapid response to changes in project scopes, etc.

Reasons to Resort to Outsourcing for Fintech Companies

Often fintech companies are thinking about whether to start outsourcing. Here are some reasons that can convince you:

- In the case of outsourcing, it is not at all about hiring employees for the in-house staff. Thanks to the outsourcing model, the company receives technical expertise in the fintech sector and the development of its solution. At the same time, the customer not only receives high-quality services but also saves money in terms of the absence of costs for recruiting, providing a workplace, and other operational costs.

- Fast expansion of the team by specialists with relevant skills. For example, the customer sees that his fintech solution is developing rapidly and raises the need to accelerate development or increase the number of specialists to support the application, then the team can be quickly scaled. However, it can also work in the opposite direction, when the customer reduces the team size.

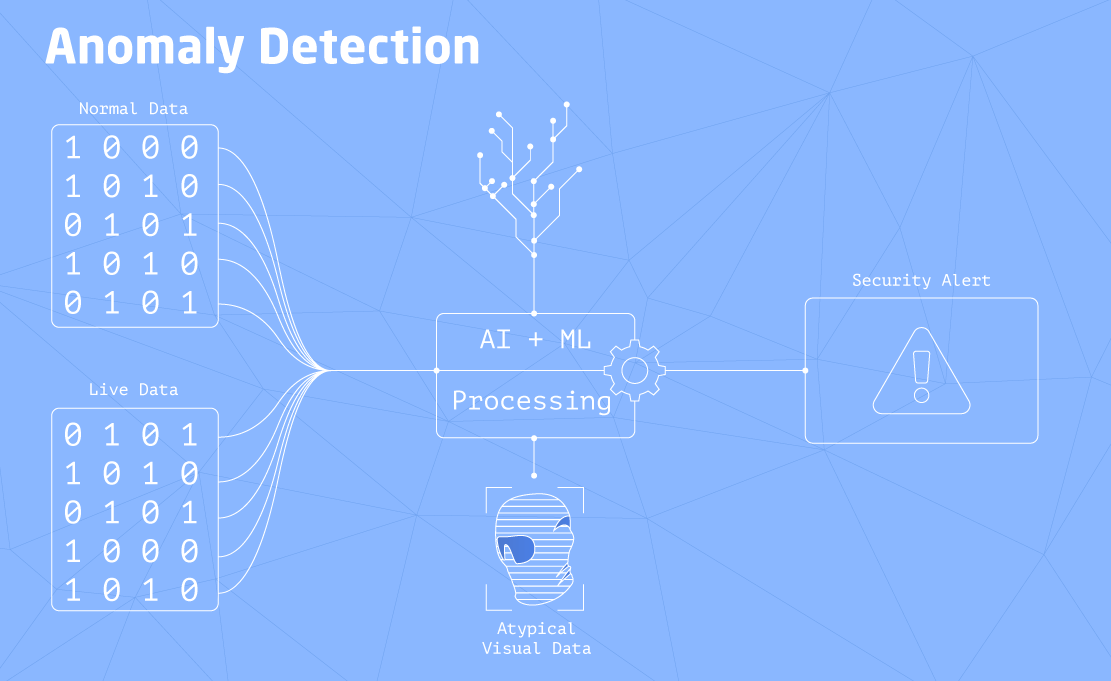

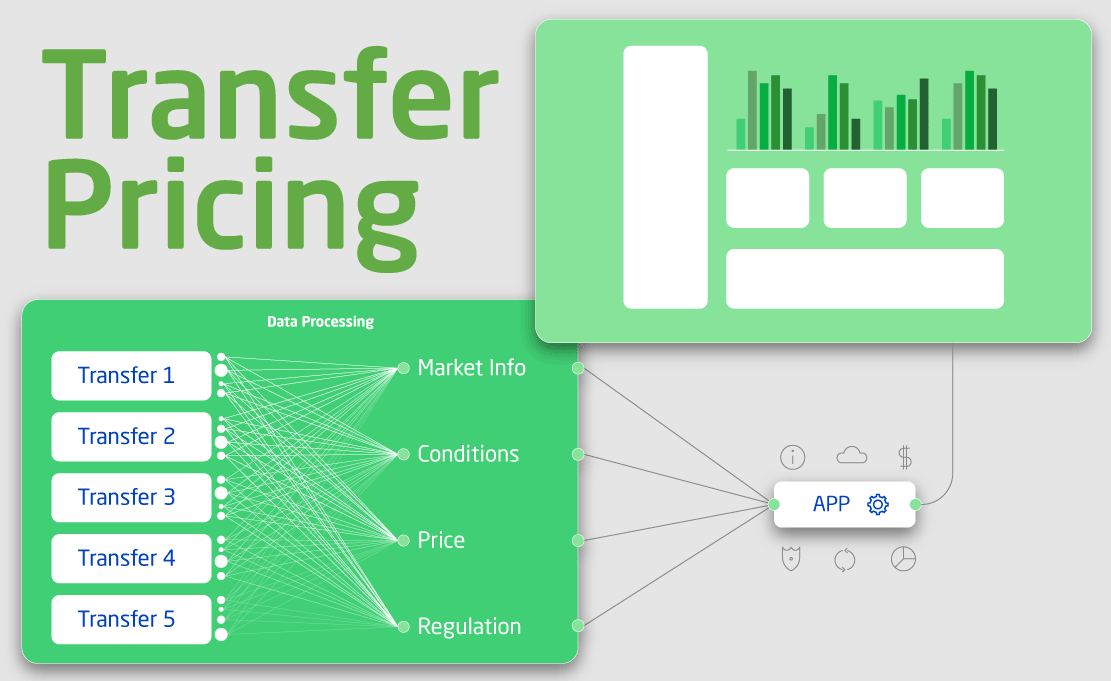

- Access to competencies that are currently not available in the in-house team. For example, the customer has fintech software & internal development team. The customer wants to develop and integrate an AI algorithm into their application but does not see the need to hire an AI engineer on their internal team. In this case, the customer can decide to outsource the development of the AI algorithm and its integration.

- Companies often resort to outsourcing to solve certain insurmountable challenges. In this case, fintech outsourcing plays the role of a kind of problem solver.

- Development of a ready-made solution for a company without expertise in this area. This is the case when the customer prefers to focus on its core business activities and wants to delegate the development of a technical solution.

Conclusion

Outsourcing in the fintech industry can be defined as one of the drivers of progress from the technical point of view. Outsourcing services are flexible considering the customer’s needs, goals, and challenges. Choosing a partner for cooperation is a balanced decision based on several factors described above. The Chudovo company is a financial software development provider that values its customers, offers flexible cooperation models, and is a reliable partner for long-term cooperation.

Frequently Asked Questions

Why choose Chudovo for fintech development outsourcing?

Chudovo is a software development company that has been operating for more than 15 years and serves clients from various industries, including fintech. Our software engineers have an average of 5+ years of experience, a strong technical background, and good software skills. Our development teams have real experience in the implementation of complex fintech systems and know how to solve certain challenges that may arise.

How to monitor the progress of the outsourced fintech solution development?

There are many ways to monitor development processes and progress. For example, the customer can monitor the progress of specific tasks through the task management system, where the project is being conducted, or through the relevant appointed persons from management; it is possible to organize demos at certain intervals (for example, at the end of a sprint); reports, and other ways.