BFSI, taxation

Development of the payroll calculator API from scratch. The API is connected to the existing front-end part of the W-2 form generator and executes automatic calculations of taxes based on the set of rules.

BFSI, banking

Development and maintenance of the module for monitoring customer transactions and identifying potential fraud attempts. The financial solution helps to anticipate and prevent suspicious transactions.

BFSI, insurance

Development of the web platform for selling & purchasing used cars in the form of an auction. The solution covers all stages of the car sale and offers insurance services for the purchased autos.

BFSI, Lending

Features development and maintenance of the loan service. The platform enables business assessment and offers funds in the form of online lending.

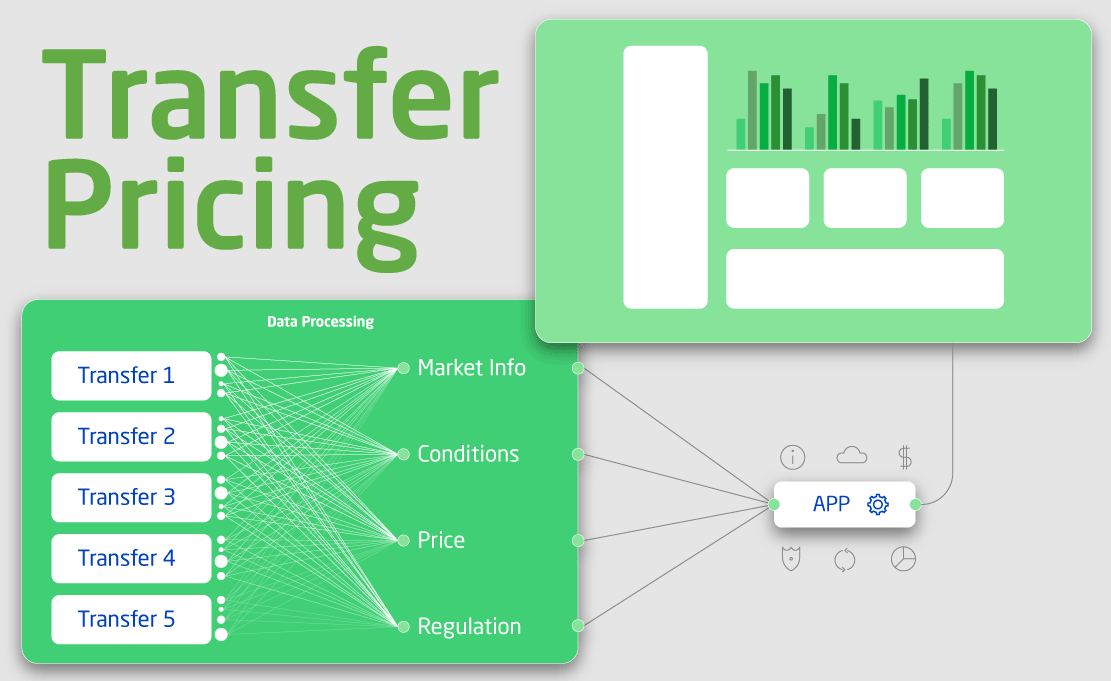

BFSI, Payments

Development of the solution for gathering, clustering, and archiving the transactions to handle the transfer pricing problem.

BFSI, Payments

The development of a web crowdfunding platform for collecting donations on charity projects with an option to use several payment methods like PayPal, credit cards, wallets, etc.

Reach out to our experts to start communication about the potential cooperation on the fintech project. Our team will contact you in the shortest time to discuss project details. It is important to note that our engineering teams besides financial software development also provide consulting services.

On the one hand, our fintech development teams can help build a product from scratch, taking over all phases from conceptualization, identification of product viability, design, architecture, development, testing, and product delivery. On the other hand, we are ready to take over work on already existing fintech products, we offer support and maintenance, software modernization, IT audit services, and more.

Reach our experts to get a free consultation, analysis of your project, and offer of the services that might help your business.

Financial services software development is a direction that requires an understanding of the industry and the specifics of the product to be developed, the target audience that will use the software, etc. Usually, the budgets for the development of the financial software can be estimated based on the precise specifications of the product. However, there are lots of projects where product requirements are not available or are unclear. Commonly, the final cost for the development of the banking applications is influenced by the following factors:

Chudovo offers different, flexible cooperation models, depending on the project type:

As for the development of applications from scratch, the choice of the tech stack is based on the requirements for the future application. It is impossible to list 100% of factors that influence the choice. Anyway, it is possible to list some of them. First, it is necessary to understand what type of application will be developed: a web platform, a mobile application, or a simple desktop tool. Secondly, the functionality itself, the scale of the application (simple application with basic features or large-scale enterprise system), its scalability, the potential number of users who will use the software, the scale of data for processing and storage, the development of some parts of the system will take place from scratch or there will be integration with external systems (for example, the development of a custom CRM or the connection and customization of an existing solution), and much more. Thirdly, it is also important to understand the budget and expected delivery time of the product.

If we are talking about an existing financial solution, then it already has a certain selection of technologies. In this case, we offer the customer to hire developers and other specialists to develop and support the existing software with the appropriate skills and abilities. In addition, our teams provide consulting and IT audit services. There are cases when customers order an IT audit to analyze their IT infrastructure and software solutions in order to identify shortcomings and identify possible ways to improve the system (including recommendations regarding the migration of the existing system to other technologies in order to solve their current problems).