AI-Driven FinTech: The Next Frontier in Financial Technology

With the growing integration of artificial intelligence and fintech, the financial sector continues to experience immense modification in its processes, using AI in fintech has brought about an important transformation concerning the way we make investments, manage, and spend money. Book a consultation with us to join the next frontier.

Table of Content

What is AI in fintech?

Fintech or Financial technology describes the strategic implementation of innovative technologies to make available and enhance the delivery of financial services. This includes an extensive category of technological ways to overcome common challenges by fintech providers, applications, and platforms that implement digital solutions to offer financial service in an increasingly effective, easy-to-use, and intuitive way for users.

AI in fintech is characterized as the implementation of natural language processing, machine learning, statistical analysis, and neural networks to empower financial institutions. These tools examine information from consumers to assist with decisions based on that data, adherence to regulations, and a complete client experience. This involves a chatbot that keeps track of queries from customers to good credit predictive computation. This solution is currently forming the cornerstone of the financial sector.

Fintech companies use new developments to make banking accessible on smartphones and information to predict customers’ needs. Financial services are not only made convenient but also personalized. This is to improve the experience of users. Electronic transactions modify conventional banking services because people no longer need to be present at banking halls always while they make transactions directly from their phones. It aims to solve the problems in the financial sector and improve the effectiveness of operations.

The use of generative AI helps improve all the aspects involved in financial operations, this includes giving customers updated information about high-risk loans, helping them enjoy an efficient banking experience that pushes innovation and is transforming the global economy.

Fintech businesses are changing the game totally for customers through the use of these advanced technologies, bringing an exciting period of personalized, accessible, fast, and productive banking services.

Features of AI in fintech

The fintech industry has improved various facets of financial services with the use of artificial intelligence and machine learning, which includes customers’ experience – people can get payment done easily using online transactions that are automated by their service providers, and they can identify fraudulent activity – some institutions create a means to immediately alert their user on their bank app when an irregular transaction occurs in their bank account. Integrating these tools into fintech represents an important change in the approach in which financial services are controlled and provided because processes are automatically managed to help strengthen the efficiency and service of the provider. It brings a substantial advantage and sets up an optimistic trajectory in the world of finance.

Fintech AI allows banks and other financial service providers to detect fraud, automate service delivery, and cut running costs. This sort of technology could be implemented to customize the experience of users, improve transparency and legal compliance, protect information of customers, and minimize risks.

Technique for fraud identification.

Banking security is significantly enhanced with the identification of fraud implemented into systems. Financial institutions can easily recognize and address threats faster – because this process is automated to give the bank an alert whenever an uncommon transaction occurs compared to traditional techniques. Machine learning is used to detect patterns that indicate fraudulent activity. This is particularly helpful in the management of transactions. Rapidity and precision are critical in preventing fraudulent transactions and lowering monetary damages.

Technology based on this solution can easily recognize fraud. For instance, some fintech providers watch customers’ accounts using chatbots, and in case of any suspicious activity, the bank can be alerted. Some search for changes and discrepancies in users’ transactions, such as transfers to accounts in countries with high risks.

Advanced customer service.

Customers’ service and experience are improved using chatbots because they respond to frequently asked questions, uncover solutions, and support users with activities related to their accounts. Besides addressing fundamental queries, they can perform complex tasks like processing payments, providing particular financial guidance, and changing customer support into value-added services. This will not only increase customer satisfaction but will help human representatives spend more time on harder problems, increasing work productivity.

Several of these solutions help users monitor their spending, set objectives to save money, and submit applications for loans, while some manage complaints from customers and forward them to human representatives if necessary, bringing about efficiency in operation.

Financial advisory service.

Systems are incorporated with artificial intelligence models to perform investigations and examine data to figure out how well customers can handle risks, financial goals in terms of how much they intend to save and spend each month, and what things they spend their money on, and investment choices. This allow them to generate customized recommendations and optimize investment outcomes and help users handle their finances, keep track of their expenses, and cut down wasteful spending. Some may additionally offer insurance tax guidance and alert users whenever they go beyond their budget. You can also be interested in reading the guide for insurance app development.

Systems like these are capable of tracking the investment portfolios of users, suggesting strategies for investing , and offering simplicity and accessibility formerly available only to those with substantial assets. These automated advisors are growing the market related to investment and are improving financial literacy among the public.

Internal Operations.

Internal processing is another use of AI in banking and finance, which includes welcoming new staff and company compliance. Some technologies equipped with AI aid financial professionals and sales representatives by providing needed information about customers’ financial history so that they help users make informed decisions with their money. Some of these systems can automate the review procedure of company documents removing the use of manual work. This saves time and reduces human error.

The majority of financial institutions use AI to keep track of their computer systems and ATMs, enabling them to identify potential problems and minimize interruption of operations, thereby improving their capacity to handle security compromises and prevent leakage of sensitive information from malicious people.

Risk handling.

Machine learning help evaluate information about the market, the flow of money, sources of financing, and liquidity metrics that are important and can help institutions manage risk. This particular category identifies trends and irregularities that may influence financial institution market behavior.

Financial organization uses neural networks to predict and anticipate possible limitations on liquidity, identifies risks associated with operation, technical issues, or errors made by humans, thus facilitating banks to protect their internal processes and clients.

Data-driven strategic planning.

By comprehensively evaluating information with the use of artificial intelligence the financial sector can readily and easily make concrete decisions on how to make calculative plans and develop policies that will give them insight into market flow and help many financial institutions see how people use their money, identify common problems that affect banking operations, know clearly customers choices, in order to design an appropriate solution that will drive improvement. This approach, based on information, helps financial service providers find solutions quickly to the marketplace and simplify business operations while offering greater value to customers and others.

These significant developments improve artificial intelligence advancement in refining operations, methods of making decisions, evaluation of data, and customer interaction in the fintech sector.

Behavior evaluation.

Financial goods and services are customized using artificial intelligence to evaluate the behavior of users. Knowing the spending habits of consumers and choices for investment whereby they like to invest their money in trending and popular stocks in the market or they prefer to fix it in the bank so that it accrues interest over a period of time. This helps financial organizations to tailor their offers toward customers’ particular needs. This level of personalization increases customer satisfaction and increases revenue.

The benefit of AI in fintech

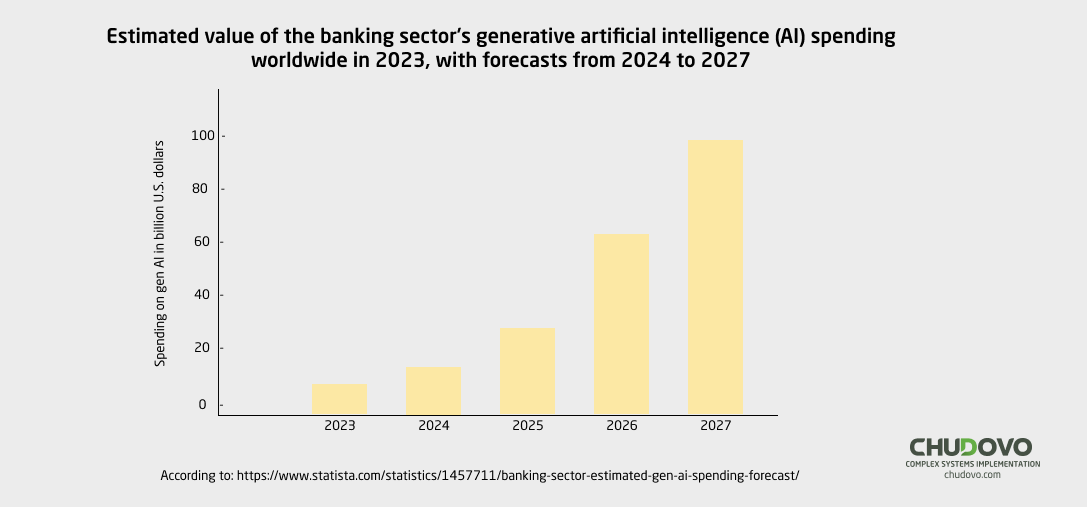

The banking sector is investing so much in the use of artificial intelligence in solving problems.

According to Statista, $27 billion dollars was invested in fintech solution by the financial industry in the previous year. This is because the technology is seen as having the potential to transform the industry. In 2027 it is predicted that they would have invested around $97 billion dollars into this business.

The artificial intelligence systems used in fintech can delegate responsibilities and provide specific recommendations. It can easily be integrated into already existing processes like client management relationship software. There are other benefits associated with the use of this method in the fintech industry.

Lending policies and enhancing interaction with clients.

The implementation of AI in fintech development is pushing organizations toward more intelligent functioning models. Essential improvements include:

- Bots that communicate. Customer service is refined with an effective and versatile interaction because these bots readily respond to and provide support for customers when needed.

- Provision of credit. The lending procedure in the financial industry has been transformed with a more precise risk assessment.

Development in predictive analysis technique and task automation.

The ability of artificial intelligence includes:

- The use of predictive analytics offers a deeper understanding of prospective market trends and client’s habits.

- Automation of duties requires simplifying complex processes in order to allow personnel to have enough time to work on more important assignments.

Evaluation of data and boosting customization.

- With neural networks and natural language processing, clients get to enjoy customized experiences.

- Using artificial intelligence to navigate and fully interpret huge volumes of statistical information for strategic planning helps in making informed decisions.

Digital transformation and the evolution of the financial industry.

Financial institutions integrate artificial intelligence into their operations so that they can provide seamless services for their users. customers’ experience is improved because there are available automated support procedures that can help a user solve their problems easily. Costs expended on labor are now reduced for these sectors because some processes are handled automatically by the system, and focus can be placed on more complex tasks on the ground. This leads to good banking operations and the provision of quality service to customers.

Certified engineers

Convenient rates

Fast start

Profitable conditions

Agreement with

EU company

English and German

speaking engineers

Blockchain in fintech

The financial industry is using blockchain technology to change It whole process of providing banking services to customers. It is an addition of a strong digital record-keeping system that ensures openness such that users have complete control over their money without a third party being involved, for transactions to successfully occur between two parties the person initiating the transaction will have to create a public key so that the second person can easily confirm their ownership of the asset before engaging.

Advantages of blockchain in fintech

- Transparency

Blockchain increases openness through the implementation of standard rules and procedures for communicating through those who make up the network. It guarantees the confidentiality of information and a more rapid execution of transactions, therefore enhancing every aspect of the customer’s interaction and experience.

- Trust

Its unchangeable and comprehensive authenticity of the blockchain-based databases promotes assurance between many different parties in an organization’s network, ensuring efficient communication and transfer of information. Thereby increasing the general confidence and reliability in financial transactions.

- High performance and scalability.

Blockchain-based systems in financial services have been developed for very efficient operations with the capacity to expand and manage several transactions in seconds. This consists of hybrid and exclusive networks engineered to promote compatibility throughout private as well as public chains, providing stability across the globe for organizations that use blockchain technology for their transactions.

- Security

The use of blockchain in finance makes certain high safety through the utilization of impermeable software code, which makes it extremely hard for security to be breached, therefore strengthing the entire safety condition of the financial system.

- Privacy

Blockchain infrastructure provides more information protection and includes numerous software levels of data, which enables selected sharing of information within the organization network holding onto anonymity and security, establishing an appropriate balance between openness and data safety.

Challenges and Limitations of Blockchain for Fintech

Blockchain has different importance and creative applications in the financial industry. However, it is not perfect. It has a significant challenge. Just like it will be difficult to give instructions to many groups of people trying to make decisions simultaneously that is one of the major challenges of this technology in fintech. Because in this system, everyone has the ability to control their own transaction operation, it becomes slow for the system to process a large number of transactions.

If a large number of transactions are being processed on the blockchain system all at once it slows down the operation. so, the number of users and transactions that happen per second increases it becomes hard for the system to sort all transactions successfully and efficiently. But, solutions like layer-2 and sharding – where the system used to keep users’ information are separated from each other according to how rapidly they process transactions, are used to hasten procedures.

Scalability issues.

Blockchain is faced with the problem of scalability, this is why the system finds it really hard to effectively do many transactions at once. This downside is stopping the financial industry in utilizing this solution on a wider scope. Some digital currency platforms such as Bitcoin and Ethereum are poised with this problem because their system only has a limited capability to handle big transaction operations.

Integration with legacy system.

Leveraging the blockchain in legacy systems has proven to be a challenge because the expenditure in carrying out this process is very costly. Legacy systems have been created with the concept of centralization, which is contradictory to the decentralized characteristics of blockchain. To achieve the goal of fusing this technology into a traditional system, It requires time-intensive preparation, competence and plenty of funds. Moving existing data to a new platform and standardized user interface could be a challenge to control during integration.

FAQ

What is generative AI in FinTech?

In fintech, this is used to swiftly track transaction procedures. It easily detects strange trends showing that there is a potential alteration somewhere which helps maintain market credibility.

What is AI used for in financial services?

AI allows banks and other financial service providers to detect fraud, automate service delivery, and cut running costs. This sort of technology could be implemented to customize the experience of users, improve transparency and legal compliance, protect information of customers, and minimize risks.

What is machine learning in FinTech?

Machine learning can evaluate information about the market, the flow of money, sources of financing, and liquidity metrics that are important and can help institutions manage risk.

Book a consultation with the expert team of Chudovo software engineers to build a fintech application for you that leverages AI.