How To Make A Peer-To-Peer Payment App

Millions of people in the United States use peer-to-peer payment apps on their phones for money transfers as payments for services, to send money to friends, and to request payments from peers. That’s not surprising, as p2p payment apps are secure and reliable. They’re even usurping traditional banking as the faster way to move cashless money around without waiting forever.

But these P2P transfer apps aren’t easy to develop and release to the market. P2p apps require thousands, sometimes millions of dollars, a room of creative experts, and that one person who’s crazy enough to start the engine. If you fall in the last category and want to develop a peer-to-peer payment app like Venmo and Cash App, this guide is for you.

In this article, we’ll discuss how to make a peer-to-peer payment app, the features every payment app needs, and the steps you can take to reach Cash App’s level of success in your p2p payment app development. Keep reading to get all the information you need to create a Cash App of your own.

Table of Content

What Is A Peer-To-Peer Payment App?

P2P payment apps are software products that facilitate electronic money transfers between peers and acquaintances. A P2P payment app can come in either a mobile application that needs to be downloaded from an app store or a web app that can be accessed via an internet browser.

P2P means peer-to-peer or person-to-person. Hence, it covers money transfers to and from just about anybody, including your friends, family, acquaintances, local shop owners, etc. As long as they use the same payment app, you and them can move money between each other’s accounts.

There are four types of peer-to-peer payment apps: independent financial services, social network platforms, smartphone manufacturers, and traditional banking-centered payment apps. Your company type, app objective, and target audience will determine the type of p2p app you develop.

There are many independent p2p payment apps, with examples like Zelle, Paypal, Venmo, and Cash App. People who want to engage in P2P payment app development should study the features and functionalities of these successful payment platforms. The following section will discuss the features that must be included in every P2P payment app development.

Must-Have Features of a P2P payment app

When you begin your peer-to-peer payment app development, there’s the temptation to include every feature you can chip in, but that’s not ideal. To start, every P2P payment app needs the following features:

- Wide adaptability

- Multiple payment methods

- Instant or fast money transfers

- Retail shopping payment

- Money request

- Multi-factor authentication for security

- Instant notifications

Wide Adaptability

Your p2p payment app should be able to serve a diverse and vast portion of the market. PayPal, for example, is used widely among business owners to collect payments from customers, and individuals also use it to send funds to friends and family.

Multiple payment methods

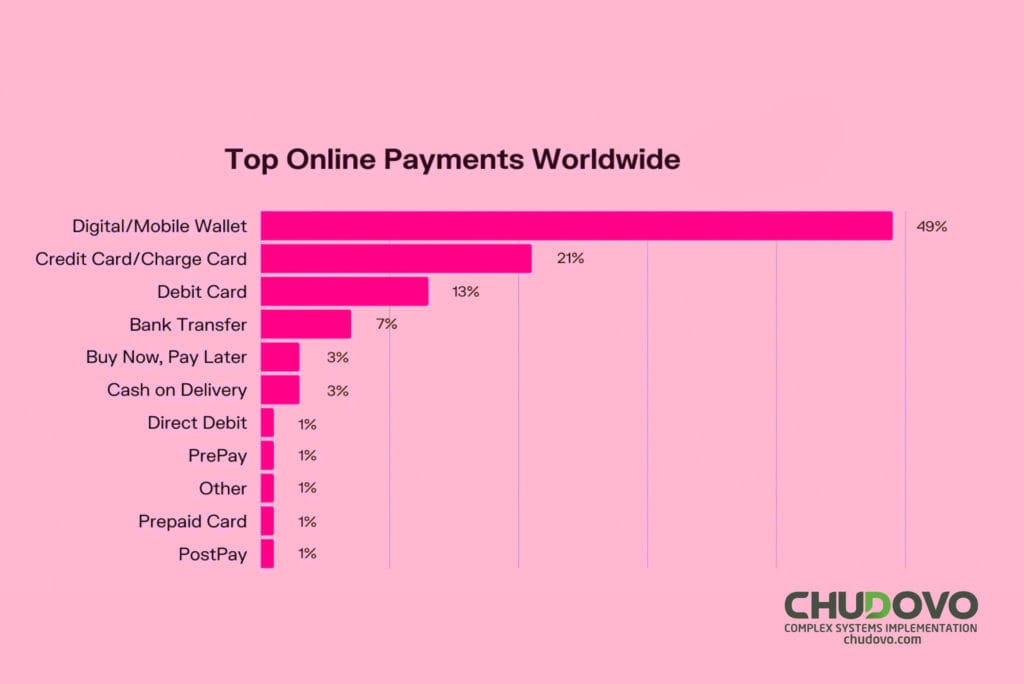

The payment app should have an in-app cash balance, but users should have other options for sending payments and receiving payments via multiple channels. The point is for them to have more than one way to make and receive payments to avoid getting into tight corners during an emergency.

Instant or fast money transfer

If your users wanted to spend five to fourteen days to receive or send money, they’d have gone to the bank. Your p2p payment app needs to overthrow the position of traditional banks as their go-to route for money transfers, and you can only do that by helping them send money faster than their banks, if not instantly.

Retail shopping payment

Aside from sending money to close friends as a primary function, some peer-to-peer developers can include a retail shopping payment functionality that enables users to pay for their shopping online and in stores. That way, your users will have more reason to use the app, and you’ll ultimately increase customer engagement.

Money request

The money request feature may be as important as the fast money transfer feature. Users should be able to request urgent funds from those close to them. For example, young adults under parental care should be able to request funds from their parents.

Multi-factor authentication

When it comes to your users’ money, a one-time password or pin isn’t enough. While the user is responsible for not sending money to strange people, the developers can also set up a multifactor authentication feature to boost security at sign-in, money transfer, and money withdrawal.

Instant notifications

Whenever a user logs in, sends, or receives money, the p2p payment app should send a push notification to notify the user of the change. Thus, if someone else logs into the account or performs a transaction, the account owner will receive an instant push, email, or text notification and take necessary actions.

Certified engineers

Convenient rates

Fast start

Profitable conditions

Agreement with

EU company

English and German

speaking engineers

What’s The Process For P2p Payment App Development?

Before you learn how to create a Cash App, you must first know the steps for peer-to-peer payment app development. The universal process for mobile software product development, also called the new product development life cycle, includes the following steps:

- Define your mobile app’s goals, audience, objectives, and competition

- Set plans and analysis for features, project roadmap, requirements, etc

- Determine user interface and user experience design

- Set parameters for app development for framework, stack, milestones, and architecture

- Manual or automated testing

- Launch your new product

For a digital peer-to-peer payment platform, the process is similar, but a few changes will be made. Here’s the process for p2p payment app development:

- Select your type of peer-to-peer payment app

- Prioritize mobile platforms

- Definition and discovery phase

- Select and define the features

- UI/UX design

- Prioritize app security

- Ensure legal compliance

- Conduct product testing

- Product launch and data analysis

Select your type of peer-to-peer payment app

Begin by choosing the p2p payment app type you wish to develop. The development, features, and target user of your p2p payment app would depend on what type of p2p app you decide on.

Prioritize mobile platforms

Hardly anyone will use their computer or iPad to send payment to their peers, except if it’s strictly for business purposes or for paying employees and suppliers in a company. If you plan to target the everyday user, then p2p mobile software product development is the way to go.

Definition and discovery phase

This stage is where you ask all the questions regarding your unique user profile, features, competitor p2p payment apps, platforms you’ll release the payment app on, and many more. The main goal is to have a skeleton of your minimum viable product (MVP).

Select and define the features

Developers can start with the list of must-have p2p payment app features listed previously and glean some from the admirable Cash App features below. If you’re working on a tight budget, it’s always better to start with the most basic and unique features first for your MVP before branching off into more functionalities when you can afford them later.

UI/UX design

In this stage, you and your software development team define and draw up ideas for the user interface and user experience design. Ask questions concerning colors, icon placement and design, animations, user journey, and many more. To design an app with a unique user interface and user experience design, you’ll need to have studied your competition, see what’s working for them, what you can improve on, and what you can bring from your creativity.

Prioritize app security

As mentioned earlier, your p2p payment app security is incredibly crucial to the success and reception it gets. If users feel like their information and funds aren’t secure on your platform, they’ll go for a more secure option even if they don’t have as many features as yours. Consider security features such as a thumbprint, facial recognition, two-factor authentication, password, transaction pins, and many more.

Ensure legal compliance

Financial technology software and mobile apps are required by law to ensure they’re compliant with all Payment Card Industry Data Security Standard or PCI-DSS rules and regulations. PCI-DSS is a set of rules that are designed to ensure that organizations that accept or use credit cards are operating at maximum card security. Consider acquiring a PCI-DSS certification to give your users confidence about your services.

Conduct product testing

This stage is where you determine if your product is free of bugs and glitches and is ready for the market. Once your p2p payment product is ready, you’ll need to test it via manual or automated methods. Most developers prefer mobile app automation testing because it saves time and is less hectic than manual tests.

Product launch and data analysis

Once everything, including your marketing plan, is set and ready to go, launch your p2p payment app on your chosen platform and hope everything goes according to or even better than planned. After the payment app is live, it’s not the time to cross your legs because you still have work to do. You must begin analyzing data about app performance, audience reviews, and customer feedback.

Now that you know the basic steps for p2p payment app development, let’s take one more action forward and analyze one of your major competitors in the p2p payment app market, Cash App. We’ll discuss how to create a cash app by emulating some features that make it successful.

Popular Payment Apps: How To Create A Cash App-Like P2p App

Cash App is a popular p2p payment platform that enables users to send money to their peers quickly through a series of simple steps. Aside from its primary feature for money transfers, Cash App has additional features.

Other features of the P2P cash app include an avenue for buying bitcoin and investing in stocks. It also gives users a fully-functional bank account and a debit card they can use at automated teller machines (ATMs).

Cash App is arguably the most successful peer-to-peer payment platform out of 2022. It’s one of the fastest ways to send and receive money to and from anyone as long as you have their CashApp tag or phone number.

Among the top P2P payment apps, Cash App is a top contender for the market favorite. Before we leave you to begin your mobile software product development for your payment app, let’s discuss a few features that make Cash App worthy of emulation.

What makes Cash App Unique?

If you want to make a peer-to-peer payment app that resonates with your target market and meets their needs quickly, then you need to know how to create a cash app P2P platform by emulating some moves that Cash App made. Try out the following when making your payment platform:

Unique username, Cashtag

If you want your users to stay loyal to your p2p payment app and use it often, you’ll need to create a certain vibe for them to relate with. CashApp users can create unique and searchable user tags that another user can search for to send the user money.

Easy access to sign up

To register as a new user, you only need your name, phone number, email address, and zip code. The only time the app requests more personal information is when users want to increase their transaction limits.

A simple user interface

What’s a p2p payment app without a simple user interface that makes it super easy for users to send and receive money quickly? If there’s anything you want to copy from the cash app’s design, it should be their straightforward user interface. During your payment app development process, you’ll need to consider how your typical user might use the app, what they’re used to from other payment apps like CashApp, and if you can change it.

Reasonable cash limit

Cash App has an easily affordable minimum cash transaction limit of $1. So even if a user wants to send or receive $1 to $5, they don’t have to worry about the limit. The maximum amount is up to $250 within seven days and $1000 within thirty days, but users can increase their limit by confirming their identity with identifier information.

No Monthly fees

CashApp doesn’t charge monthly fees or service charges on the amount you save on your app balance. But how’s the service paid for? Through transfer charges for other services like the 1.5 percent fee for instant deposits.

User Engagement

As a payment app that wants to reach its intended audience, Cash App came prepared with celebrity-led social media campaigns and financial literacy courses that help its younger users learn how to manage their finances. For example, HipHop rapper Meghan Thee Stallion has some financial literacy videos about spending, saving, and investing.

Conclusion

P2P mobile payment apps are gaining ground as the fastest way to send and receive money. Developing a P2P payment platform is difficult, but if you follow the process outlined below, then you should be on your way to developing a competitive fintech app.

To ensure your product’s success in the fintech market, clearly define your target market from the start and center your app’s functionalities around them. These include future updates, user interface, user experience, features, pricing, fees, and more. Overall, satisfying the needs of your clearly defined target audience is the key to creating a successful p2p money transfer mobile app like Cash App.

FAQs

What is a p2p payment app?

A peer-to-peer payment app is a mobile application that facilitates digital money transfers between peers.

What are the types of p2p payment apps?

The major types of p2p payment applications are independent financial services, social media platforms, smartphone manufacturers, and traditional banking-centered payment apps.

How to make a p2p payment app with steps?

To make a peer-to-peer payment app, follow these steps:

- Select your type of peer-to-peer payment app

- Prioritize mobile platforms

- Definition and discovery phase

- Select and define the features

- UI/UX design

- Prioritize app security

- Ensure legal compliance

- Conduct product testing

- Product launch and data analysis

What are the basic features of a peer-to-peer payment app?

The essential features of a peer-to-peer payment app are wide adaptability, multiple payment methods, instant or fast money transfers and requests, a digital wallet, retail shopping payment, instant notifications, and security features. Developers can also program different variations of these.

How to create a Cash App?

Study and copy some unique features and decisions by the Cash App developers. These features include their celebrity-led user engagement, zero monthly fees, reasonable cash limit, and simple user interface.

What are the top peer-to-peer payment apps?

According to NerdWallet, the most popular and most used P2P payment apps are Zelle, PayPal, Venmo, and CashApp.

If you need highly qualified P2P app developers at the right price for your project, contact us now!