The Ultimate Guide to Developing a Mobile Investment Application

In a world where digital transformation has revolutionized how we conduct business, investment practices are no exception. Mobile investment apps have gained substantial prominence, democratizing access to financial markets and empowering individuals to make informed investment decisions from the palm of their hands.

This comprehensive guide unravels the complex process of creating a mobile investment app, offering valuable insights into various facets of development, from cost considerations to team requirements. If you’re keen on building a successful investment platform that stands out in the crowded marketplace, you’re in the right place.

Table of content

- Overview of the Online Mobile Investment Market

- Overview of Investment Startups and Their Investment Rounds

- 5 Types of investment apps

- Features of mobile investment apps

- How Much Does It Cost to Develop a Mobile Investment App?

- Things to Do Before the Actual Development Process

- Developing a mobile Investment App in 3 Steps: A Step-by-Step Guide

- Team or Stack Required to Develop a Mobile Investment App

- 3 Examples of Notable Mobile Investment Apps and What Startup Founders and Developers Should Learn

- Conclusion

- FAQs

Overview of the Online Mobile Investment Market

The online mobile investment market has witnessed exponential growth in recent years. With the advent of smartphones and increasing internet penetration, investors are now more inclined to manage their investments on the go. But what exactly is the online mobile investment market, and why is it so promising?

Definition

The online mobile investment market encompasses a broad spectrum of investment-related activities conducted through mobile applications. It includes trading stocks, managing investment portfolios, accessing financial news, and utilizing various financial tools and resources via mobile devices.

The primary reasons for the rapid growth of this market are convenience and accessibility. Investors can now make informed decisions and execute trades from the palm of their hand, no matter where they are. The ability to stay connected to the financial world 24/7 has become necessary for today’s investors.

Overview of Investment Startups and Their Investment Rounds

To gain deeper insights into the online investment market, let’s take a closer look at some notable investment startups that have disrupted the industry. These companies have redefined how people invest and secured substantial funding through various investment rounds.

Robinhood

- Funding Amount: Robinhood, founded in 2013, secured an impressive $280 million in its Series F funding round.

- Key Features: Known for its commission-free trading, Robinhood’s user-friendly interface and real-time market data have attracted millions of investors.

- Success Story: Robinhood’s journey reflects its mission to democratize investing. By offering accessible and affordable trading, it has empowered a new generation of investors, challenging the traditional brokerage model.

Acorns

- Funding Amount: Acorns, founded in 2012, raised a noteworthy $105 million in funding.

- Key Features: Acorns introduced micro-investing by rounding up everyday purchases and investing the spare change. Its simplicity and automated savings features have made investing more approachable.

- Success Story: Acorns has resonated with millennials seeking a seamless way to save and invest. It demonstrates how innovation in financial technology can foster financial literacy and responsible investing.

Coinbase

- Funding Amount: Coinbase, a trailblazer in the cryptocurrency space, has attracted a substantial $547 million investment.

- Key Features: Coinbase offers a secure and user-friendly platform for buying, selling, and storing cryptocurrencies. Its robust security measures have earned the trust of millions of users.

- Success Story: Coinbase has played a pivotal role in the adoption of cryptocurrencies, bridging the gap between traditional finance and digital assets. Its success underscores the growing mainstream acceptance of cryptocurrencies as an investable asset class.

These startups serve as inspiring examples of what can be achieved in the world of mobile investment apps. As we proceed, you’ll discover how to create a product that stands out like these success stories.

5 Types of Investment Apps

Before diving into the development process, it’s crucial to determine the type of mobile investment app you want to create. The choice of the app’s focus will significantly influence its development, features, and target audience. Here are some common types of investment apps:

1. Stock Trading Apps

These types of apps enable users to buy and sell stocks, ETFs, and other financial instruments in real time. They often provide real-time market data, news, and analysis tools.

2. Robo-Advisory Apps

Robo-advisors use algorithms to create and manage diversified investment portfolios tailored to users’ risk tolerance and financial goals. These apps are popular among passive investors.

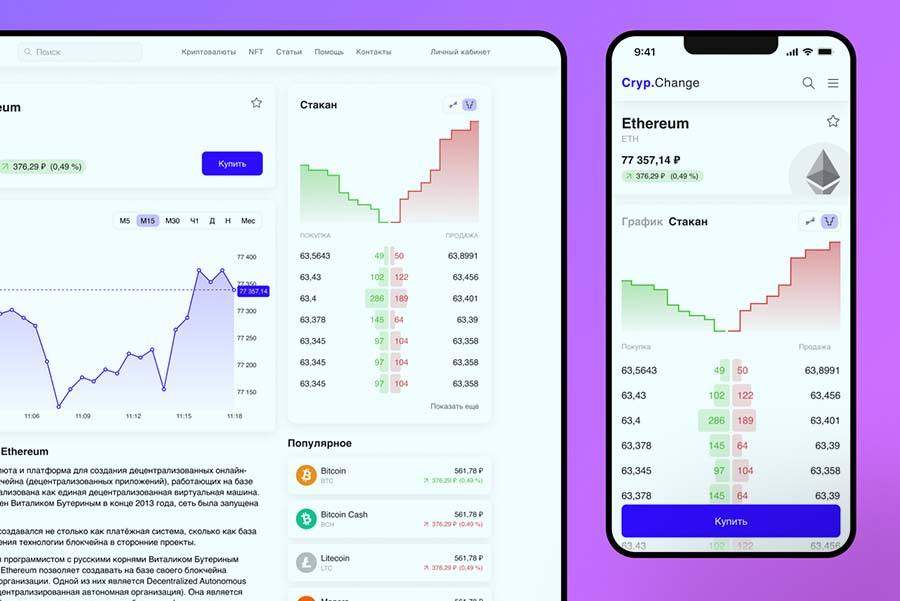

3. Cryptocurrency Investment Apps

With the rise of cryptocurrencies like Bitcoin and Ethereum, apps that allow users to invest in digital assets have gained popularity. These apps offer trading, wallet services, and real-time cryptocurrency prices.

4. Real Estate Investment Apps

These apps enable users to invest in real estate properties, REITs (Real Estate Investment Trusts), or crowdfunded real estate projects. See more information about digital transformation in real estate.

5. Peer-to-Peer Lending Apps

These platforms facilitate peer-to-peer lending and borrowing, allowing users to earn interest by lending money or accessing loans from other users.

The type of investment app you choose to create should align with your target audience and business goals. Each type has its unique set of features and functionalities, which we will explore in the next section.

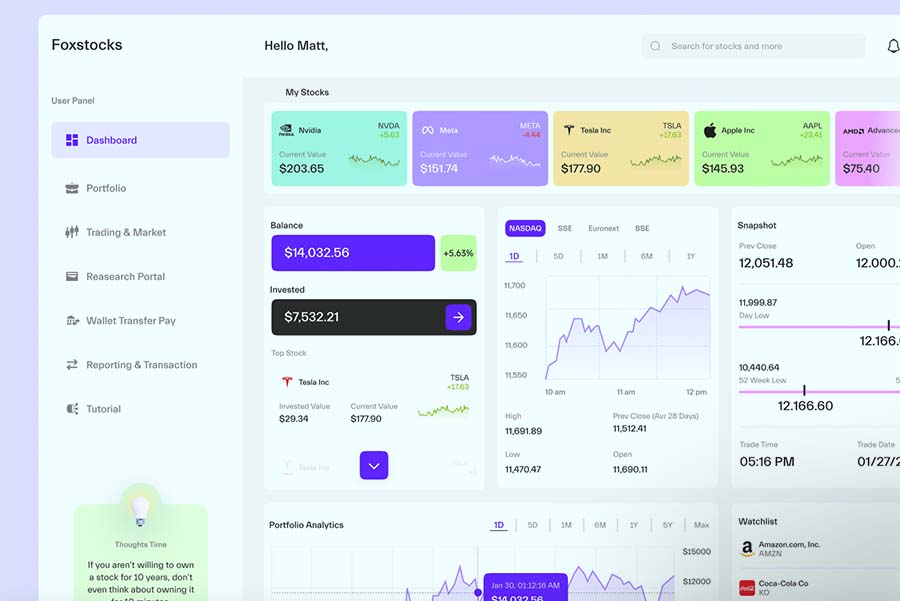

Features of Mobile Investment Apps

Successful mobile investment apps share common features that cater to the needs and preferences of investors. Here’s a breakdown of essential features your app should consider:

- Intuitive Portfolio Management: At the core of any remarkable investment app lies the ability to create, manage, and monitor investment portfolios effortlessly. Users can diversify their holdings, track performance, and make informed decisions with real-time updates.

- Real-Time Market Data: Access to up-to-the-minute market data, including stock quotes, asset prices, and economic indicators, ensures users are well-informed and poised for timely actions.

- Sophisticated Trading Functionality: Exceptional mobile investment apps facilitate secure and efficient trading, allowing users to buy and sell assets seamlessly. Advanced order types, such as limit orders and stop-loss orders, enhance trading precision.

- Robust Security Measures: Prioritizing data security and privacy is paramount. Implementing advanced encryption, two-factor authentication (2FA), and stringent security protocols instills trust in users and safeguards their investments.

- Personalized Notifications: Stay ahead of market trends with personalized notifications. Users can set alerts for price changes, news updates, and portfolio performance, ensuring they never miss a critical moment.

- Seamless Payment Integration: Integrating secure payment gateways simplifies the funding of accounts and the execution of transactions, providing users with a frictionless experience.

- Robo-Advisory Algorithms: For hands-off investors, mobile investment apps often offer robo-advisory services. These algorithms tailor investment portfolios to users’ risk tolerance and financial goals, automating investment decisions.

- Comprehensive Customer Support: Responsive and accessible customer support channels, such as live chat, email, and phone support, offer users assistance and peace of mind during their investment journey.

- Data Analytics and Reporting: In-depth analytics and reports empower users to analyze their investment performance, identify trends, and make data-driven decisions.

- Regulatory Compliance: Meeting regulatory standards, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, ensures legal adherence and builds trust with users.

- Social Engagement: Some apps incorporate social features, allowing users to engage with a community of fellow investors, share insights, and even participate in social trading.

- Cross-Platform Compatibility: To maximize reach, mobile investment apps are designed to run seamlessly on multiple platforms, including iOS and Android devices.

Mobile investment apps have evolved into comprehensive financial companions, offering a rich tapestry of features that cater to the diverse needs of modern investors. From intuitive portfolio management to cutting-edge security, these features collectively empower users to navigate the dynamic world of investments with confidence.

How Much Does It Cost to Develop a Mobile Investment App?

The cost of developing a mobile investment app can vary significantly depending on various factors. To provide a clearer picture, let’s break down the cost considerations based on two crucial factors: the type of team you choose and the team’s location.

Cost According to the Type of Team:

| Team Type | Cost (Approximate) $ |

| In-House Team | 200,000 |

| US Local Team | 250,000 |

| Outsourcing Agency | 250,000 |

| Freelance Team | 45,000 |

- In-House Team

Building an in-house team requires hiring full-time employees, including developers, designers, project managers, and QA testers. This option tends to be the most expensive but offers more control over the development process.

- US Local Team

A US-based team, while offering the advantages of being local and potentially easier communication, can be relatively expensive due to higher labor costs.

- Freelance Team

Hiring freelancers is a cost-effective option, but it may lack the cohesiveness of an in-house team. You’ll need to manage and coordinate multiple freelancers with various skills.

- Outsourced Agency

Partnering with a reputable app development agency falls in the mid-range of cost. Agencies have experience and a dedicated team, offering a balance between cost and expertise.

Cost According to Team Location:

| Team Location | Average Cost (in USD) |

| North America | $100,000 – $300,000 |

| Western Europe | $80,000 – $250,000 |

| Eastern Europe | $40,000 – $120,000 |

| Asia (e.g., India) | $25,000 – $80,000 |

The team’s location significantly impacts development costs. North America and Western Europe tend to have higher labor costs, while Eastern Europe and Asia offer more cost-effective options without compromising quality.

It’s important to note that these figures are approximate and can vary based on your specific project requirements, the complexity of features, and the team’s experience.

4 Things to Do Before the Actual Development Process

Before embarking on the development journey, there are four critical steps you should take to set a solid foundation for your mobile investment app:

Research on Compliance and Regulations

The financial industry is heavily regulated, and your app must comply with relevant laws and regulations. Research and understand the compliance requirements in your target market. Common regulations include KYC, AML, and data privacy laws like GDPR. Ensure your app’s features and security measures align with these regulations to build trust with users and avoid legal issues.

Plan Marketing Budget

Even the most well-designed app won’t succeed without effective marketing. Plan your marketing strategy and budget in advance. Consider various marketing channels, including social media, content marketing, email marketing, and paid advertising. Allocate resources to create awareness and attract users to your app.

Define Monetization Strategy

Decide how your app will generate revenue. Common monetization strategies for investment apps include subscription models, commission fees on trades, and freemium options. Your chosen strategy should align with your target audience’s preferences and the value your app provides.

Competitor Analysis

Study your competitors to identify gaps in the market and opportunities for differentiation. Analyze their strengths and weaknesses, user reviews, and app store ratings. Use this information to refine your app’s features and user experience.

Developing a Mobile Investment App in 3 Steps: A Step-by-Step Guide

Now that we’ve laid the groundwork let’s dive into the development process. Creating a mobile investment app involves three key phases: Discovery, Design, and Development and testing.

Step 1: Discovery Phase

The Discovery Phase is the initial stage, where you define the app’s concept and gather essential information. Here are the key activities in this phase:

- Market Research: Conduct thorough market research to understand user preferences, pain points, and competitors. Identify your app’s unique selling points (USPs).

- User Personas: Create detailed user personas for app design and feature development. Consider factors like age, income, investment experience, and goals.

- Feature Prioritization: Based on research and user personas, prioritize the features and functionalities that will be included in the MVP (Minimum Viable Product). The MVP should focus on core features that deliver value.

- Technology Stack Selection: Choose the appropriate technology stack for your app’s development. Consider factors like scalability, security, and platform compatibility.

- Prototyping: Create wireframes and prototypes to visualize the app’s user interface (UI) and user experience (UX). Prototyping helps you refine the design before development begins.

Step 2: The Design Phase

The Design Phase focuses on creating a visually appealing and user-friendly interface. Here’s what this phase entails:

- UI/UX Design: Work with designers to create an intuitive and visually appealing user interface. Ensure that the app’s design aligns with your brand and user expectations.

- User Flow: Define the user flow and navigation within the app. Ensure it’s intuitive and easy for users to navigate through various screens.

- Graphic Assets: Create icons, graphics, and other visual assets that enhance the app’s look and feel.

- Prototyping and Testing: Develop interactive prototypes for user testing. Gather feedback and make necessary adjustments to the design.

Step 3: Developing and Testing Phase

With a solid plan and design in place, it’s time to move on to the development and testing phase. Here’s what you’ll be doing:

- Development: Start coding the app’s features according to the prioritized list from the Discovery Phase. Follow industry best practices and coding standards to ensure a robust and scalable application.

- Quality Assurance (QA): Implement a rigorous testing process to identify and resolve bugs, glitches, and usability issues. Testing should cover functionality, security, and performance aspects.

- Beta Testing: Conduct beta testing with a select group of users to gather feedback and identify any remaining issues.

- Security Auditing: Perform a comprehensive security audit to protect user data and financial transactions from potential threats.

- Performance Optimization: Optimize the app’s performance to ensure smooth operation during peak usage.

- User Acceptance Testing (UAT): Invite a group of users to perform UAT to validate that the app meets their expectations and functions as intended.

- Deployment: Once all tests are successful, release the app on app stores (e.g., Apple App Store and Google Play Store). Ensure that app store guidelines and regulations are followed.

Team or Stack Required to Develop a Mobile Investment App

Creating a highly sought-after investment app requires the right team and technology stack. Here’s a breakdown of the key elements you’ll need:

Team Required:

| Required Team Role | Description |

| Project Manager | Oversees the development process, manages timelines, and coordinates tasks. |

| UI/UX Designer | Designs the app’s user interface and user experience for maximum usability. |

| Mobile App Developers | Experienced developers proficient in iOS and Android app development. |

| Backend Developers | Build and maintain the server-side infrastructure and APIs. |

| Quality Assurance (QA) | Test the app thoroughly to identify and resolve any issues. |

| Security Expert | Ensures the app is secure and compliant with industry regulations. |

Technology Stack Required:

| Aspect | Tech Stack |

| App Development | Swift (iOS), Kotlin (Android), or cross-platform frameworks like React Native or Flutter. |

| Backend Development | Node.js, Ruby on Rails, Python (Django), or Java (Spring Boot). |

| Database | PostgreSQL, MySQL, or NoSQL databases like MongoDB. |

| Cloud Hosting | AWS, Azure, or Google Cloud for scalable and secure hosting. |

| Security | Implement SSL/TLS encryption, OAuth 2.0 for user authentication, and security best practices. |

These elements form the foundation of your app development process. Assemble a competent team and choose the right technology stack to ensure the success of your mobile investment app.

Certified engineers

Convenient rates

Fast start

Profitable conditions

Agreement with

EU company

English and German

speaking engineers

3 Examples of Notable Mobile Investment Apps and What Startup Founders and Developers Should Learn

To gain inspiration and insights, let’s take a look at these three notable mobile investment apps that have made a significant impact in the market:

1. Robinhood

Founders: Vlad Tenev and Baiju Bhatt

Description: Robinhood disrupted the investment industry by introducing commission-free stock trading. It offers a user-friendly interface and has gained a large following among young investors.

Notable Feature: Fractional shares, allowing users to invest in stocks with as little as $1.

2. Acorns

Founders: Jeff Cruttenden and Walter Cruttenden

Description: Acorns is a micro-investment app that rounds up users’ everyday purchases and invests the spare change in diversified portfolios.

Notable Feature: Round-up feature, automated investing, and personalized portfolio recommendations.

3. Coinbase

Founders: Brian Armstrong and Fred Ehrsam

Description: Coinbase is a leading cryptocurrency exchange and wallet app offering a secure platform for buying, selling, and storing cryptocurrencies.

Notable Feature: Wide range of supported cryptocurrencies, user-friendly interface, and security features like two-factor authentication.

These apps have revolutionized the investment industry and garnered a loyal user base. Studying their success stories can provide valuable insights into what works in the mobile investment app market.

Conclusion

Creating a mobile investment app is a challenging yet rewarding endeavor. With the right team, technology stack, and strategic approach, you can develop an app that stands out in the competitive market. Remember to prioritize user experience, security, and regulatory compliance to build trust with your audience.

Always remember that success in the online investment app market is not guaranteed, but a well-executed app with compelling features can stand out and attract a loyal user base. Continuously gather user feedback, adapt to changing market dynamics, and prioritize security and compliance to ensure the long-term success of your investment app.

FAQs

What are the key features of a mobile investment app?

Key features of a mobile investment app include portfolio management, real-time market data, trading functionality, security measures, notifications, payment integration, robo-advisory algorithms, customer support, analytics, and reporting.

How much does it cost to develop a mobile investment app?

The cost of developing a mobile investment app varies based on factors like the type of team (in-house, freelance, or outsourced) and the team’s location. In North America, costs can range from $100,000 to $300,000; in Asia, it can be as low as $25,000 to $80,000.

What should I do before starting the development of a mobile investment app?

Before development, research compliance and regulations, plan your marketing budget, define your monetization strategy, and perform competitor analysis. These steps will lay a solid foundation for your app’s success.

What steps are involved in developing a mobile investment app?

Developing a mobile investment app involves three main steps: Discovery Phase, Design Phase, and Developing and Testing Phase. Each step has its set of activities and goals, as detailed in the guide.

Now that you have a comprehensive understanding of the process and considerations involved in creating a mobile investment app, it’s time to turn your vision into reality. Partner with Chudovo, a reliable investment app development team, to bring your product from ideation to a live application that appeals to your desired market and audience. Contact us today to start your journey towards a successful mobile investment app.